Calculating Late TTM Revenue Loss Part 2: Industry Product Lifecycles

by On Jun 27, 2011

This is the second article in a series about how to calculate revenue losses due to delivering a product late to market. In this article I’ll compare the product lifespan and development cycle times of various industries and describe how sensitive product revenues are to product introduction times in these industries.

![]()

Industry Product Lifecycles Differ Greatly

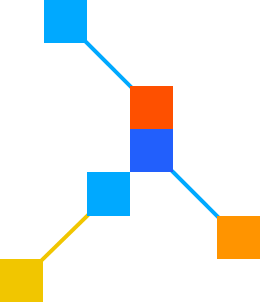

The bar chart above shows the product lifecycles for various industries, with the lifecycle consisting of the development cycle time followed by a period where the product exists in the market, i.e. its useful product life span. [Prasad]

What you will notice is that one set of industries has the shortest development cycle time and the shortest lifespan: Consumer electronics / computers /mobile phone. Coincidentally, for about two-thirds of all fabless semiconductor companies, these industries account for 60% of their revenue. This is expected to grow to 80% of their revenue within the next 5 years. [KPMG/CEA/GSA]

What this means is that of all the industries on this chart, the CE, computer, and mobile phone industries are the most sensitive to being late to market. This is because their very short product life spans, and development times that equal one-third of these life spans, combine to create a risky environment where being even one month late reduces the product life span and revenue potential by a significant percentage.

What that means is that a much-hyped consumer electronics product that misses its Christmas, back-to-school, or Chinese New Year launch window has much of its expected revenue consumed by competitors’ products.

Let’s compare this with the airplane assembly industry by examining the experience of Airbus assembling the world’s largest passenger airplane, the Airbus A380. Airbus announced the A380 in 2000 and its first flight was in 2005. It is expected to have a useful product life (called “service life” in the aircraft business) of 20 years or more. There’s a lot of slop in the development cycle to rebound from mistakes, and a long useful product life over which Airbus can amortize the cost of those mistakes.

Now, even though the consumer electronics, mobile wireless and computer industries have the shortest development times and shortest product life spans, the end device manufacturers within these industries are not the most time-compressed companies in the value chain. That honor goes to the semiconductor IC companies who supply these device, phone and PC vendors.

Semiconductors are the Most Sensitive to TTM Pressures

The critical semiconductor components within these products, such as applications processors and mobile phone modems, have a LONGER development time than the actual end product and a correspondingly SHORTER useful product life span. For example, from personal experience and anecdotal evidence, we have about a 1.5 year development time for applications processors with a 2 year product life span. But a mobile phone only takes one year to design and build and lasts on the market for less than two years!

Because it takes tens of millions of dollars of fixed expense to develop one of these chips, being late to market by only a month or two can mean little or no profit from the chip. Late TTM for a semiconductor vendor is a profit killer.

In the next article we will look at how when a product is introduced (either early or late to market) changes its price, revenue and market share potential.

Sources:

[Prasad] Biren Prasad, “Analysis of Pricing Strategies for New Product Introduction.” Volume 5, Number 4 of Pricing Strategy and Practice, pages 132-141, 1997. http://www.emeraldinsight.com/journals.htm?articleid=855140.

[KPMG/CEA/GSA] KPMG/CEA/GSA, “The Consumer Electronics Boom: How Semiconductor and Consumer Electronics Companies Can Improve Cost, Time-to-Market and Product Quality.” http://www.gsaglobal.org/publications/cestudy/index.asp.